I am already on record for several years arguing about the US sovereign debt, currently around $20T. ($5T of that held by the fed).dmp said:It's just nuts and totally devoid of common sense and integrity.

A tax cut to INCREASE the deficit already approaching a trillion dollars a year. The most recent deficit was $666 billion.

This tax cut will add $1.5 trillion of debt over ten years - probably push the deficit over a trillion dollars a year.

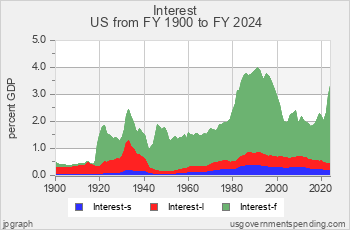

The debt is extremely high in historical terms, due to nearly 30 yrs of deficits brought on primarily by the Reagan and GWB tax cuts and both parties refusal to cut spending.

This current tax cut is hitting the gas when you're headed to a brick wall.

It would only be possible to put off the day of reckoning if interest rates could continue to decline (as they have for 30 years) but they are bouncing off zero now.

All late in the cycle of a bull market. Next economic downturn will be from excessive debt, rising interest rates, and it will hit hard.

An increase of $1.5T over a decade seems tame compared to the $1T a year increases we've experienced since 2007. Scoring debt increases 10 years out is obviously less certain than the recent past history.

I decline to argue about the future that we can not know with certainty (like will the fed unwind the extraordinary easing without unintended consequences?). The elephant in the room surrounding budget deficit discussions is GDP growth... The government has a bias toward deficit budgets, so only decent economic growth can mitigate sovereign debt growth...

The average GDP growth since 1947 is 3.2%, we are just now returning to average GDP growth trend after years of below average growth.

I remain optimistic that we can beat 3% growth with current policy trends, I am less confident that we can unwind the $5T of fed owned debt without repercussions, but very slowly would be advised.

JR

![Electronics Soldering Iron Kit, [Upgraded] Soldering Iron 110V 90W LCD Digital Portable Soldering Kit 180-480℃(356-896℉), Welding Tool with ON/OFF Switch, Auto-sleep, Thermostatic Design](https://m.media-amazon.com/images/I/41gRDnlyfJS._SL500_.jpg)