Under Biden it's done nothing but increase from $2.4x to now $4.32.

Between Jan of 2020 to mid 2021, prices were below the moving average of Trump's last term in office. The minimum price was May of 2020 ($1.80). Prices didn't rise back to Jan of 2020 levels until Feb of 2021. Coincidentally they track the price of crude oil almost exactly.

So just to make sure I understand the argument, prices were always rising under Biden (except when they weren't), but the disastrous policies that he put into place when he took office didn't actually effect prices until a little over one year later (coincidentally exactly when COVID restrictions were starting to lift world-wide)?

Allow me to offer an alternate explanation (that happens to match the data): gas prices are set by the global price of crude, and driven by the regular supply-demand curve, just like every other internationally traded commodity. Modulo starting a war with an oil producing country, who is sitting in the White House is far less important.

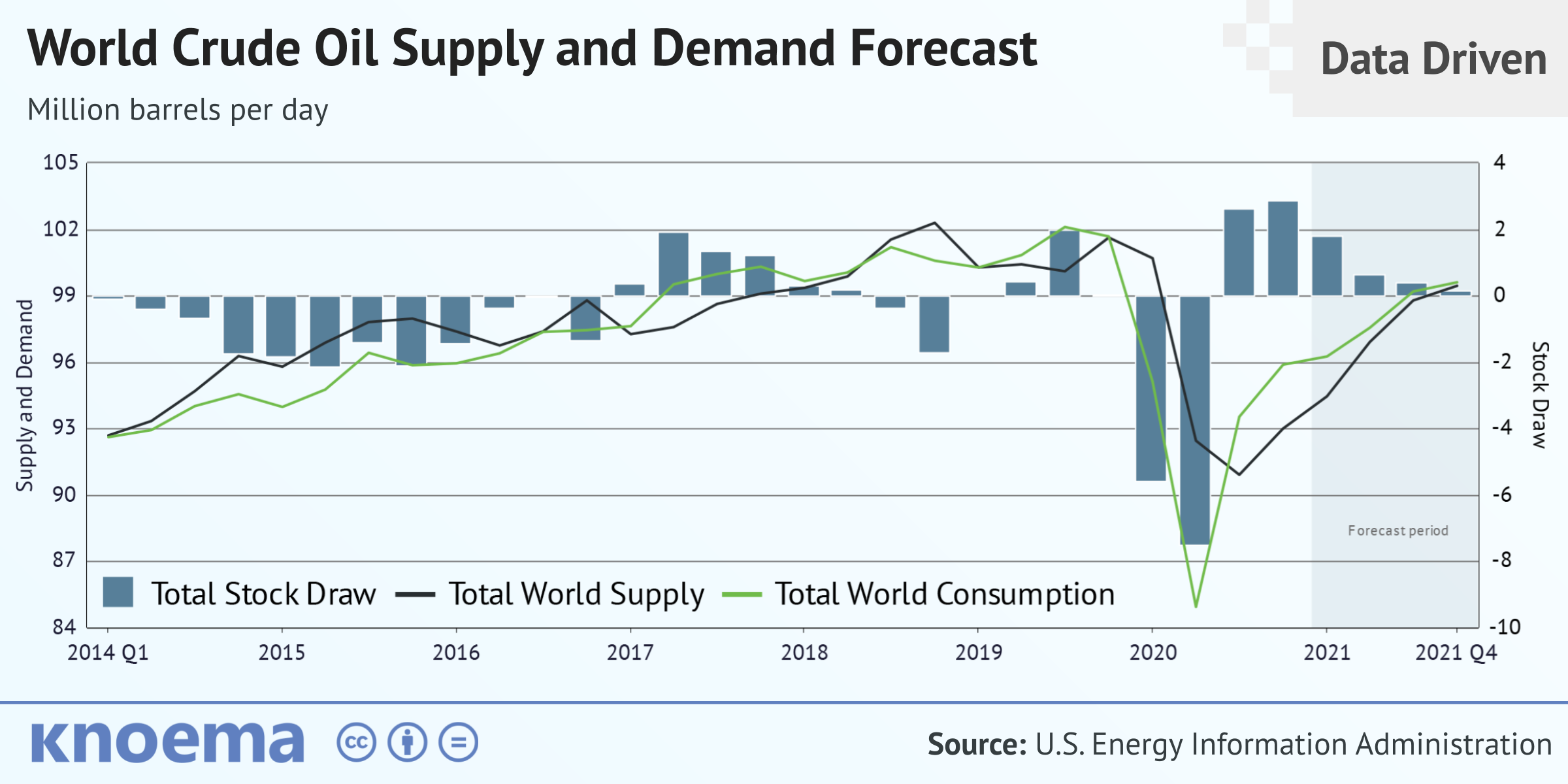

If you overlay the gas price chart cited above over the global supply demand curve, they happen to line up exactly:

Demand fell sharply in late 2019 (I wonder what that was? Maybe Biden's first executive order that everyone needed to be sneezed on by someone who is COVID positive?), and crude oil prices cratered in the following months as world-wide demand dried up. Ever since, demand has recovered quicker than supply, putting upwards pressure on prices (because of course it does, just like any other global commodity in supply/demand imbalance). Notice that global supply still hasn't recovered to the levels pre-pandemic by nearly 10 million barrels per day.

We can flip the argument backwards and see if the logic still holds up: Biden's disastrous policies are responsible for the price of gas, but Trump's weren't. So during Trump's term, the oil industry was in an orgy of expanded drilling, and energy companies were free to unleash their product on the market to contain prices, and make sure that supply and demand were in balance. Finally the free market was unburdened to solve all of our problems.

They why did gas prices rise broadly between 2016 and 2020? Why didn't the energy industry do as John suggests, and increase supply to meet demand since they were finally free to do so?

But oil companies are making profits at an all time rate (which is simultaneously impossible because Biden's policies are crushing these companies), so where are all those profits going if not to increasing supply?

"Investors in energy stocks have been a bit thrown off by the volatility, so they're looking more for energy firms to pay back down their debt, or return money to shareholders, rather than going and investing in new wells — even if those new wells would be profitable," Ashworth said.

In other words, many companies are choosing to enjoy their high profits rather than increase the supply of oil. That's despite the relatively low oil price they would need to turn a profit. On a different Dallas Fed question, executives said oil prices between $23 and $38 a barrel, on average, would cover the cost of drilling new wells.

"Investors have demanded restraint and capital discipline of their client companies," one survey taker told the Dallas Fed.

Another said: "Discipline continues to dominate the industry. Shareholders and lenders continue to demand a return on capital, and until it becomes unavoidably obvious that high energy prices will sustain, there will be no exploration spending."

In completely unrelated news:

Energy companies are facing the prospects of a long-term decline in demand for oil and gas, concerns about climate change, and the push to renewable energy. In response, they’re taking their profits and rather than using that money to drill new wells are sending cash back to investors. As a result, the energy sector’s dividends are growing faster than any other part of the U.S. equity market. Since 2018, the average dollar amount of dividends among energy companies has grown by over 50%. That’s up from just 5% growth for the prior three years. And since 2016, energy companies’ dividend amounts are up 80% for the five-year period.

Thanks Biden!