Good luck trying to prove equivalency... ex-President Trump had a generally adversarial relationship with all mainstream media, if anything Fox was the outlier that didn't asymmetrically cover him. Despite all the hatred, the main stream media depended on Trump to drive the news cycle (easier than finding news to talk/write about).The outrage over the Twitter files seems highly selective and specific, with a Trump white house coordinating closely with favorable news outlets seeming to pass without comment here on GroupDIY.

The outrage about Twitter is because this is just the tip of the iceberg with similar behavior still going on in secret on other social media outlets. Twitter opened the door a crack and this is proving our suspicions about behind the scenes government intervention.

For example look at how little coverage the multiple twitter data drops have garnered.

===

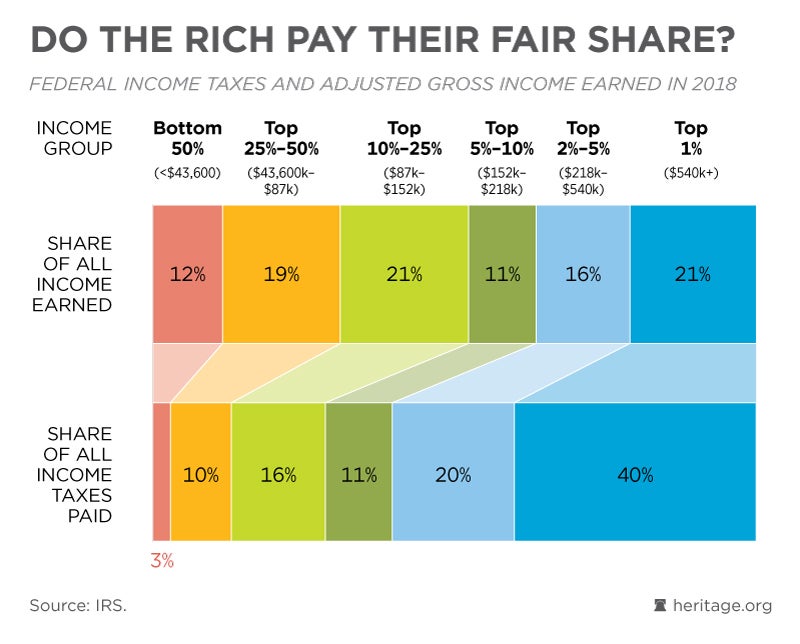

The class warfare in this one is strong... The progressive US tax system has been well inspected on this forum for years. To repeat, poor people don't create jobs.Indeed: this is a common "Wall Street Journal" screed, conflating total tax revenue with adjusted percentage of income taxed.

Someone making 50K and paying 20% (10K), compared with someone making 1M and paying 15% (150K). But the rich dude payed 15 times what the poor dude did, right! That's fair!

JR

.

![Electronics Soldering Iron Kit, [Upgraded] Soldering Iron 110V 90W LCD Digital Portable Soldering Kit 180-480℃(356-896℉), Welding Tool with ON/OFF Switch, Auto-sleep, Thermostatic Design](https://m.media-amazon.com/images/I/41gRDnlyfJS._SL500_.jpg)